Unlocking Homeownership: Understanding CalHFA’s “Dream For All” Shared Appreciation Loan Program

California, often portrayed as a land of opportunity and dreams, has in recent years faced a harsh reality – a housing affordability crisis that has made the dream of homeownership increasingly out of reach for many of its residents. To combat this, the California Housing Finance Agency (CalHFA) introduced the Dream For All, shared appreciation program, a significant initiative aimed at making homeownership more accessible and affordable for Californians. Phase 1 consisted of approximately $300,000,000 and assisted 2,182 new homeowners purchase a home. Unfortunately, the available funds were exhausted within 11 days! Let’s dive in to understand Phase 2 of CalHFA’s “Dream For All” Shared Appreciation Loan Program, how it works, what changes have been made and how it could help unlock homeownership in the Golden State.

What is CalHFA Dream For All?

CalHFA Dream for All is a state-backed program designed to assist Californians in overcoming the primary barriers to homeownership – namely, high housing prices and the challenge of saving for a down payment. The program offers down payment assistance with no interest or payments, equal to 20% of the sales price or appraised value, capped at a maximum of $150,000, whichever is lower. At the time of sale, refinance, payoff or transfer of first mortgage the homeowner must pay back the original loan amount plus any shared appreciation percentage.

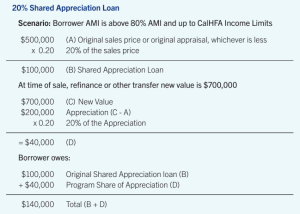

For borrowers with incomes above 80% AMI (AMI LINK) and less than or equal to the CalHFA Dream For All income limits, the shared appreciation is 20% of the home price appreciation. See image 1.

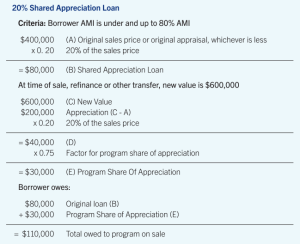

For borrowers with incomes less than or equal to 80% AMI (AMI LINK), the shared appreciation is 15% of the home price appreciation. See image 2.

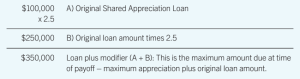

The amount of shared appreciation is capped at 2.5 times the original principal amount. See image 3.

What changes were made to CalHFA’s Dream For All?

Phase 2 will be released Spring of 2024 and will consist of approximately $255,000,000. It is expected to assist between 1,700 to 2,000 new homeowners. Nevertheless, it’s important to note that CalHFA has implemented a new process and made significant changes, focused on providing extended access to the program and prioritize the needs of new homebuyers. CalHFA will require all individuals to pre-register. This pre-registration will consist of obtaining a Dream For All (DFA) Lender Pre-Approval Letter (PDF) and complete a Homebuyer Education course specific to Dream for All Shared Appreciation Loans. (CLICK HERE) Once the pre-registration is completed and it has been determined all borrower(s) qualifications are met, the borrower(s) will be eligible to be selected through a randomized selection process (lottery) to receive a Dream For All voucher. All vouchers are expected to be issued based on a geographic balance and will allow the borrower(s) a specific time period to enter into contract to purchase a home.

What are the requirements to qualify for Dream For All?

- Each borrower must be First-Time Homebuyers: Defined as someone who hasn’t owned a home in the past three years.

- Each borrower must be either a citizen or other National of the United States, or a “Qualified Alien”: Defined at 8 U.S.C § 1641.

- Each borrower must meet credit, income and loan requirements of CalHFA’s first mortgage loan program and be pre-approved by an CalHFA Approved Lender. (CLICK HERE)

- At least one borrower must be a California resident.

- At least one borrower must complete a Homebuyer Education specific to CalHFA Conventional Loans (CLICK HERE)

- At least one borrower must be a First-Generation Homebuyer: Defined as someone who has not had an ownership in a home in the US in the last 7 years; AND to the best of the borrower’s knowledge, the borrower’s parents do not, or did not at the time of their death, have any present ownership in a residence in the US; OR an individual who has at any time been placed in foster care or institutional care (type of out of home residential care for large groups of children by non-related caregivers).

In Closing

CalHFA’s Dream For All program represents a significant stride towards making homeownership a more achievable reality for many Californians. By providing essential financial assistance and educational resources, it has the potential to transform lives and communities across the state. For those struggling to bridge the gap between their homeownership dreams and reality, Dream For All offers a path forward.

For anyone considering applying for the program, it’s essential to conduct thorough research, consult with a CalHFA Approved Lender (CLICK HERE), and possibly seek advice from housing counselors. As with any major financial decision, being well-informed and prepared is key to navigating the journey to homeownership successfully.