Credit Comeback: Your Guide to Boosting Your Credit Score

Today, let’s dive into a topic that can open doors to financial opportunities – improving your credit score. Whether you’re dreaming of a new car, a home, or just a little peace of mind, a healthier credit score can make a world of difference. Before we explore some practical steps to boost that three-digit number and pave the way for a brighter financial future, let’s take a look at what determines a score.

1. Know Your Credit Score:

First things first, get familiar with your credit score. You can obtain a free credit report from each of the major credit bureaus – Equifax, Experian, and TransUnion – once a year. Understanding where you stand is the first step towards improvement.

2. Identify and Correct Errors:

Review your credit report carefully. If you spot any errors, such as inaccuracies in your personal information, accounts that don’t belong to you, or incorrect payment statuses, dispute them. Correcting these errors can have an immediate positive impact on your credit score.

3. Pay Your Bills on Time:

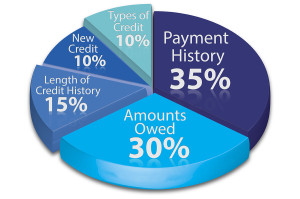

Consistent, on-time payments are the backbone of a healthy credit score. Set up reminders or automatic payments to ensure you never miss a due date. Payment history contributes significantly to your credit score, so staying current is crucial.

4. Reduce Credit Card Balances:

High credit card balances relative to your credit limit can negatively impact your credit score. Aim to keep your credit utilization below 30%. If possible, work on paying down outstanding balances to improve this aspect of your credit profile.

5. Diversify Your Credit Mix:

Having a mix of different types of credit, such as credit cards, installment loans, and retail accounts, can positively influence your credit score. However, only open new accounts when necessary, and manage them responsibly.

6. Avoid Closing Old Accounts:

The length of your credit history matters. Closing old credit accounts can shorten your credit history and potentially lower your credit score. If you have old, unused accounts with no annual fees, consider keeping them open.

7. Create a Budget:

Financial responsibility extends beyond credit. Creating and sticking to a budget helps ensure you have the funds to meet your financial obligations. A well-managed budget can prevent missed payments and support overall financial health.

8. Seek Professional Guidance:

If you’re facing challenges in improving your credit, consider seeking guidance from credit counseling services. These professionals can provide personalized advice and strategies to help you on your credit improvement journey.

In Conclusion:

Improving your credit score is a journey, not a sprint. Patience and consistency are key. By implementing these practical steps, you can take control of your credit and set the stage for achieving your financial goals. Here’s to a brighter financial future.